Copper prices fall slightly due to Israel-Iran war shock!!!

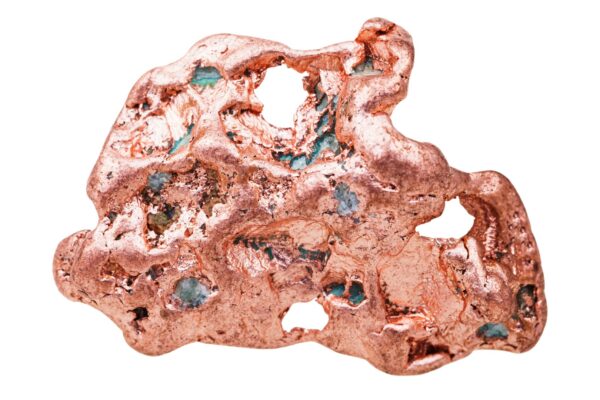

Copper prices are down 0.18% to 878.3. Investors are a little scared due to the conflict between Israel and Iran and the unclear supply-demand situation. However, prices are somewhat stable due to the low availability of copper worldwide. LME (London Metal Exchange) copper stocks are at 107,350 tons. This is 60% lower than in March…