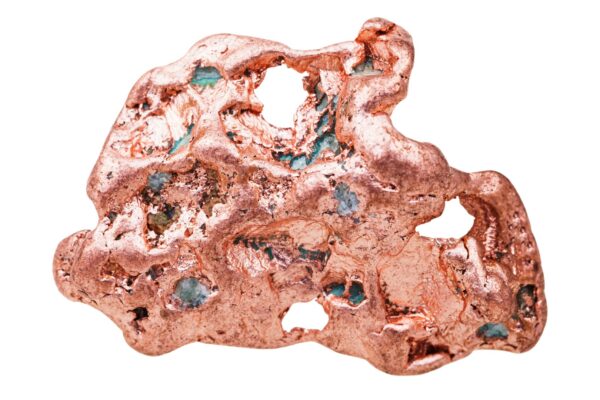

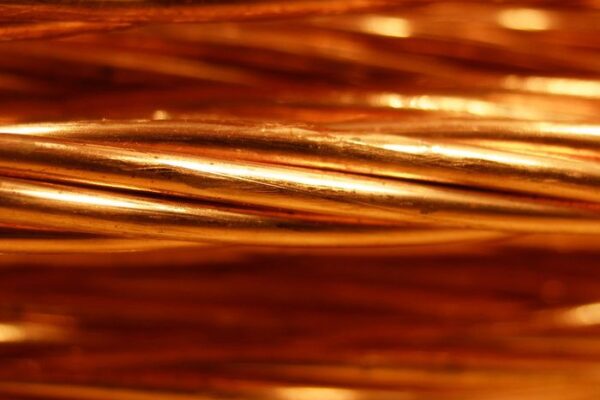

Why has the price of copper reached an all-time high?

Three-month copper futures on the London Metal Exchange (LME) have broken the $13,000 per tonne threshold for the first time, setting a new record high. After rising 11% in the last 30 days, the copper return in a year is 40%. In 10 years, the return on copper will be 11% CAGR. After reaching a…