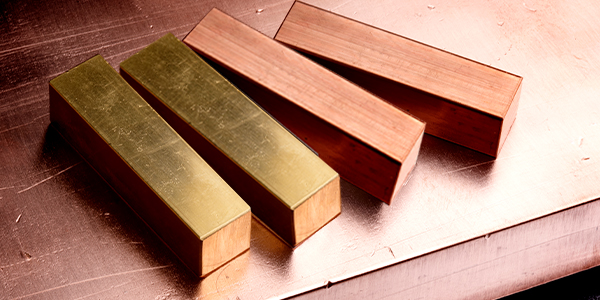

A weaker dollar and some short-covering helped copper rise

Copper prices rose by 0.48% to ₹821.05, driven by a softer dollar and short-covering activity. China’s pledge to increase debt and stimulate growth boosted sentiment, but it lacked specific details on the stimulus and limited enthusiasm. China’s weaker-than-expected September trade data raised concerns about demand, while the US Federal Reserve’s cautious interest rate cuts weighed…